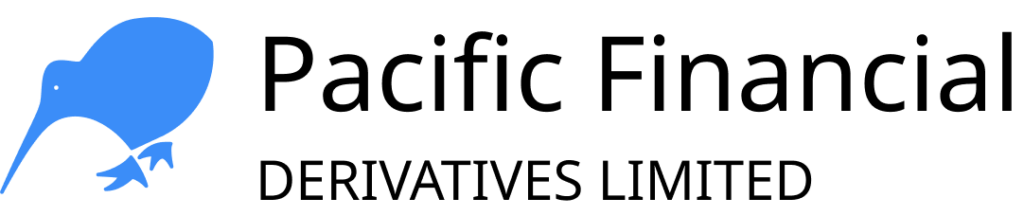

Investing is a fundamental part of wealth building, and two of the most popular investment options are stocks and bonds. While both can be effective tools for growing your portfolio, they serve different purposes and come with distinct risks and rewards. Understanding the key differences between stocks and bonds is crucial for making informed investment decisions. This article will explore the primary distinctions between the two, including ownership, risk, return potential, and investment strategy.

1. Ownership: Equity vs. Debt

The fundamental difference between stocks and bonds lies in what you own when you invest in them.

Stocks: Ownership in a Company

When you invest in stocks, you are purchasing shares, which represent partial ownership in a company. As a shareholder, you have a claim on the company’s assets and profits, depending on the number of shares you own. This ownership also gives you the right to vote on important company decisions, such as electing board members or approving mergers.

Bonds: Lending to an Entity

In contrast, when you invest in bonds, you are essentially lending money to an entity—whether it’s a corporation, government, or municipality. Bonds are debt instruments, meaning that the bond issuer (the entity borrowing the money) promises to repay the loan with interest over a specified period. Unlike stocks, bondholders do not have ownership in the issuing entity but are entitled to regular interest payments and the return of their principal when the bond matures.

2. Risk and Return: Volatility and Predictability

The risk and return profiles of stocks and bonds differ significantly, and these differences largely stem from the nature of equity versus debt.

Stocks: High Risk, High Reward

Stocks are generally considered riskier investments because their value is directly tied to the performance of the underlying company. If the company performs well, the stock price rises, and shareholders may receive dividends. However, if the company struggles or market conditions worsen, stock prices can fall sharply. This volatility means that stock investments can offer higher returns, but they also come with greater potential for loss.

For example, during periods of economic growth, stocks can generate substantial returns, sometimes in the double digits annually. However, in bear markets or economic downturns, stock prices can plummet, leading to significant losses for investors.

Bonds: Lower Risk, Steady Returns

Bonds, on the other hand, are generally viewed as safer investments, especially when issued by reputable entities such as the U.S. government or highly rated corporations. Because bondholders are lenders, they are prioritized over stockholders in the event of bankruptcy or liquidation. This means that bondholders are more likely to recoup some or all of their investment if the issuer defaults.

While bonds tend to offer lower returns compared to stocks, they provide a predictable stream of income through regular interest payments, known as coupon payments. This makes them attractive to conservative investors who prioritize capital preservation and steady income over potential for high growth.

3. Income vs. Capital Appreciation: Different Investment Goals

The goals of investing in stocks and bonds also vary, depending on whether an investor is seeking regular income or long-term growth.

Stocks: Focus on Capital Appreciation

Stock investments are often geared toward capital appreciation—growth in the value of the investment over time. Investors buy shares in companies with the expectation that the stock price will increase as the company grows or improves its profitability. This growth in stock value can result in substantial returns if the shares are sold at a higher price than their purchase price.

While some stocks also pay dividends—regular payments to shareholders from company profits—the primary goal of stock investing is often capital appreciation. This makes stocks particularly attractive to growth-oriented investors with a higher risk tolerance.

Bonds: Emphasis on Income Generation

Bonds, on the other hand, are typically favored by investors looking for regular, predictable income. Bondholders receive fixed interest payments, which can be a reliable source of income, especially during periods of market volatility. This steady income stream is often used by retirees or conservative investors to generate cash flow while protecting their principal investment.

For example, government bonds or high-quality corporate bonds are known for providing consistent income with relatively low risk. This makes them a go-to option for income-focused investors who prioritize stability over growth.

4. Investment Horizon: Short-Term vs. Long-Term

The time horizon for investing in stocks and bonds can also differ significantly, depending on an investor’s financial goals and risk tolerance.

Stocks: Long-Term Growth Potential

Stocks are generally considered long-term investments due to their higher volatility. While stock prices may fluctuate significantly in the short term, historically, the stock market has trended upward over the long term. This makes stocks an ideal investment for individuals with a long-term horizon who can ride out short-term market volatility in exchange for potentially higher returns.

Investors who have time on their side, such as those saving for retirement or future financial goals, may benefit from the long-term capital appreciation that stocks can provide. However, this strategy requires patience and the ability to withstand temporary losses.

Bonds: Shorter-Term Stability

Bonds, especially those with shorter maturities, are often used for short- to medium-term financial goals. Since bonds offer fixed interest payments and return the principal at maturity, they are a good option for investors who need to preserve capital for upcoming expenses, such as buying a home or funding a child’s education.

While long-term bonds also exist, they may be more susceptible to interest rate fluctuations. As a result, short-term bonds or bond funds are often favored by investors who prioritize stability and have a shorter investment horizon.

Balancing Stocks and Bonds in Your Portfolio

Stocks and bonds serve different purposes in an investment portfolio, and the decision to invest in one or the other depends on your financial goals, risk tolerance, and time horizon. Stocks offer the potential for high returns through capital appreciation, but come with increased risk and volatility. Bonds provide steady income and lower risk, but with less potential for growth.

A balanced portfolio often includes a mix of both stocks and bonds, allowing investors to capitalize on the growth potential of stocks while mitigating risk through the stability of bonds. By understanding the key differences between these two asset classes, you can make informed decisions that align with your investment strategy and long-term financial objectives.